Concept in Definition ABC

Miscellanea / / July 04, 2021

By Florencia Ucha, on Jul. 2009

The term Balance is used to refer mainly to two questions. In the first place, when we want to give an account of the result of an issue, people often use the word balance to name or refer to it. When, for example, a discussion that takes several days and comes to an end, the expression that the balance of the meetings were very positive if yes. On the other hand, when a person wants to refer to the period of introspection in which he entered to analyze each of the various issues or situations that happened to him during the period of a year, he usually speaks of it as the balance he made.

The term Balance is used to refer mainly to two questions. In the first place, when we want to give an account of the result of an issue, people often use the word balance to name or refer to it. When, for example, a discussion that takes several days and comes to an end, the expression that the balance of the meetings were very positive if yes. On the other hand, when a person wants to refer to the period of introspection in which he entered to analyze each of the various issues or situations that happened to him during the period of a year, he usually speaks of it as the balance he made.

For example, it turns out to be a very common practice at this time for individuals to make a balance at the end of the year regarding how it went in every level and sense in that year, that is, in the personal, work, family, between others.

To carry out this balance, the proposed objectives will be considered, whether they were achieved or not, what happened without intending to do so and that was good or bad. Meanwhile, the balance will be positive if, according to personal criteria, the proposed goals were achieved and if they had a good time, meanwhile, it will be negative if

balance it leans preferentially towards the bad. My balance for 2013 was positive in personal matters but not so professionally since I lost my job.The balance in economic terms

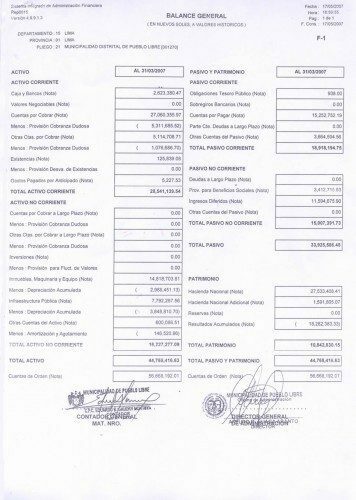

Meanwhile, the other of the most widespread uses is the one that corresponds to scope of accounting and that says that balance is that financial report that reflects the heritage of an entity, company, company in a given period, that is, the confrontation between the asset and liabilities to determine the status of the business, its investment capacity, among others issues.

The active element of a balance sheet includes all the accounts that reflect the values with which the company has, which in present or in the future, through their use, sale or exchange, they will return a certain amount of money to the company.

Meanwhile, within the asset, two types should be considered, non-current assets, which implies those assets and rights that were acquired so that they remain in the company for more than one year, that is, they will not be exchanged or sold in the short term. And the current activewhich are the goods or rights that were purchased to dispose of them for a period of less than one year, with which they will be marketed or will be disposed of before that date.

On the other side, almost always the least pleasant one that the balance has, in the liabilities, all those obligations that have been contracted and the contingencies that occurred, which, obviously, will manifest as expenses, outflows of money, either in loans, purchases with deferred payment, among other

Another issue that is always reflected in the balance sheets along with liabilities and assets and that of course is also indispensable when forming an idea about the situation financial of the company in question and the possibility that it has of self-financing, is the equity and that results from subtracting the liability from the asset. Put in simpler words, net worth is the difference between what the company has and what it owes, while it will be made up of: own funds, what came from the adjustments made, the donations received and those goods that were received as legacy.

It is important that when the balance is made, each good is classified in a satisfactory way and the costs and benefits obtained in the gross are unequivocally established. In order to carry out what is known as the General Accounting Plan, which is a kind of informative newspaper that will allow you to know how the company's financial year was, the investments achieved, the objectives achieved, among other knowledge.

The balances are carried out by the personnel dedicated to the accounting area of the company and it is necessary to have technical knowledge in the matter to be able to do so. For example, the person who signs the balance must be a professional graduated as a public accountant. Normally, the balance is carried out every six months, at the middle of the year and at the end of the year, and in the case of Stock companies are presented to the partners so that they have a complete knowledge of the accounting status of the same.

Topics in Balance