Companies That Perform Tax-Free or Tax-Exempt Activities

Accounting / / July 04, 2021

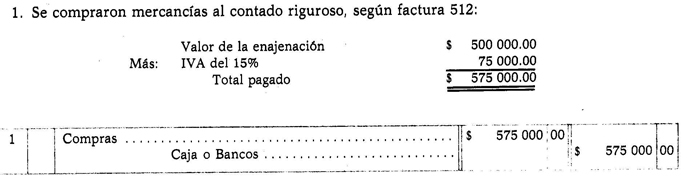

As can be seen in the resolution of the operations of the previous case, the value added tax of the operations from activities that cause the general rate of 16%, It is recorded separately from the value of the sale, the provision of services or the temporary use or enjoyment of goods, that is, in no case is the tax part of the cost or spending; However, the same does not happen; n companies whose activities are exempt or exempt from the tax, since in this case, the taxpayers do not transfer tax any to their clients, and that which their suppliers pass on to them must be increased at their costs or expenses, by virtue of the fact that there is no accreditation of the tax.

To better understand the above, the resolution of operations is presented below carried out by a company, in which its activities are exempt from or exempt from value added.

Operations.

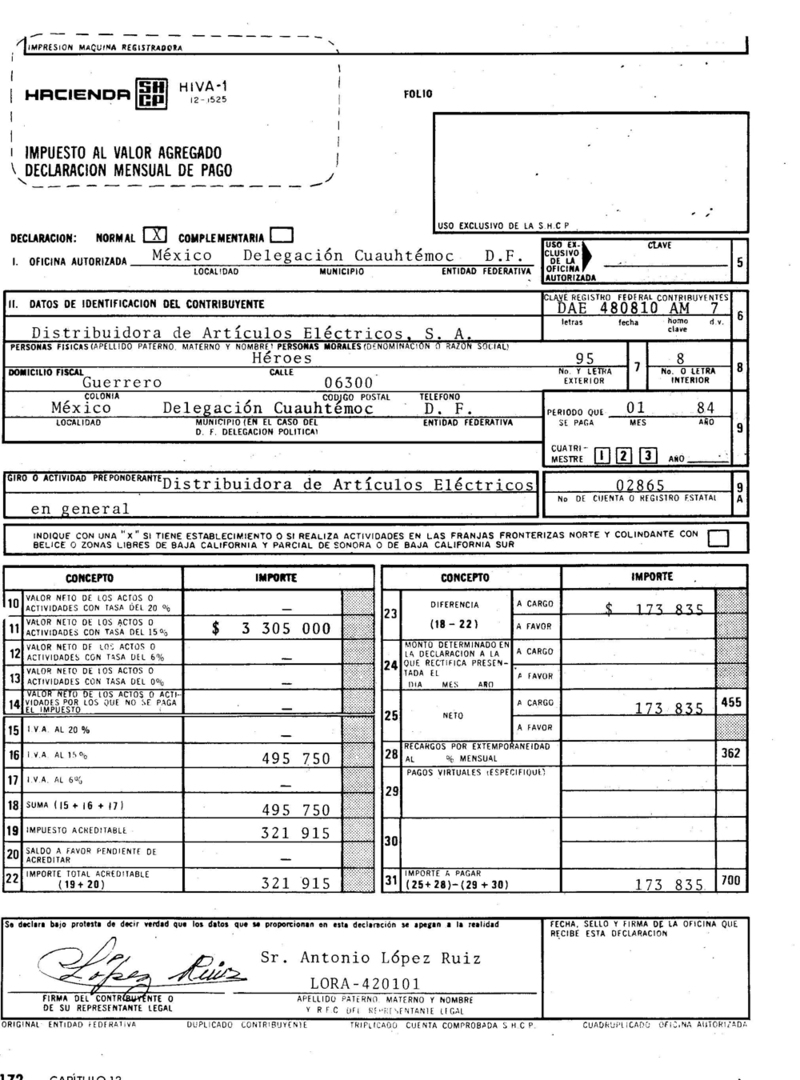

Important. See that both the value added tax that is passed on to the taxpayer by its suppliers and the one that pays for expenses and provision of Services, in this case, does increase them at their costs or expenses, by virtue of the fact that they do not transfer any tax to their clients for being released or exempt from said assessment; consequently, the companies of these taxpayers do not require an account number or state registration Before the collection offices of the value added tax, since there is no accreditation of the tax.