Example of Operating Expenses

Accounting / / July 04, 2021

The operating expenses are the expenses that the organization implanted in the company supports and that allows to carry out the various activities and daily operations. Selling, administrative and financial expenses are considered operating expenses, since without them it would not be possible to achieve the company's purposes.

In accordance with the foregoing, the total of the sum of the selling expenses, administrative expenses and financial expenses is called operating expenses.

Sales Expenses + Administrative Expenses + Financial Expenses = Operating Expenses

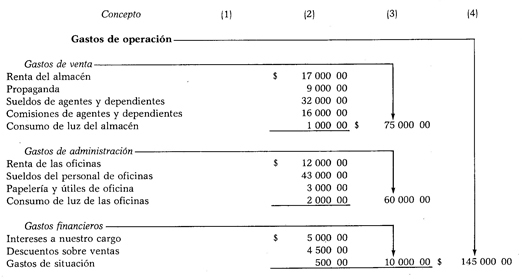

Example:

During the year, expenses were incurred with the following values:

Warehouse rent, $ 17,000.00; propaganda, $ 9,000.00; salaries of agents and dependents, $ 32,000.00; agent commissions, $ 16,000.00; office light consumption, $ 1,000.00; rent for the offices, $ 12,000.00; staff salaries, $ 43,000.00; stationery and office supplies, $ 3,000.00; light consumption of the administration department, $ 2,000.00; interest at our expense, $ 5,000.00; discounts on sales, $ 4,500.00 and situation expenses, $ 500.00.

When there are financial expenses and products, the products should be classified first, if their value is greater than expenses, but expenses should be classified first, if their value is greater than that of expenses. products. The classification should be done in this way in order to make the subtraction more easily.

The result obtained from subtracting the lower value from the higher may be the financial loss or financial profit, as the case may be; it is a loss when the value of the expenses is greater than that of the products, and it is financial profit, in the opposite case.

When the result is a financial loss, its value must be added to the sum of the selling expenses with the administration expenses, to obtain the total operating expenses.

Financial Loss = Financial Expenses - Financial Products

Selling Expenses + Administration Expenses + Financial Loss = Operating Expenses

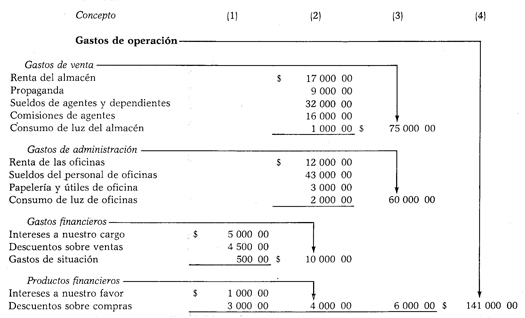

Example:

Let's assume the same selling, administrative and financial expenses as the previous case, and also, the following products: interest in our favor $ 1 000.00 and discounts on purchases $ 3 000.00.

As can be seen, first the financial expenses were classified, as their value was greater, and then the financial products were classified, the difference between both was the financial loss, which was added to the selling expenses plus the administration expenses, to obtain in this way, the total of the expenses of operation.

When the result obtained is the financial profit, its value must be subtracted from the sum of the selling expenses with the administration expenses, to obtain the total of the operating expenses.

Financial Income = Financial Products - Financial Expenses

Selling Expenses + Administration Expenses = Sum - Financial Income = Operating Expenses

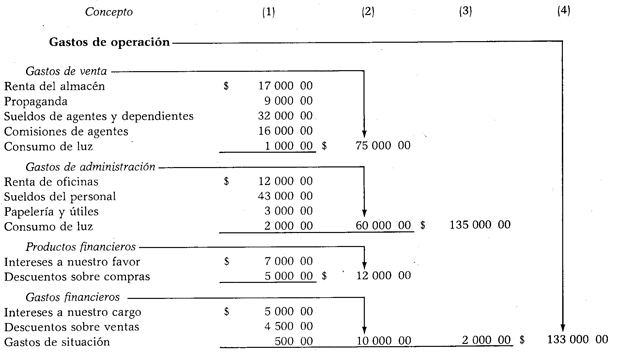

Example:

Let us consider the same data from the previous case, with the difference that the interests in our favor reach 7,000.00 and the discounts on purchases reach $ 5,000.00.

First, financial products were classified because their value was greater, and then financial expenses, the difference between the two was financial profit, which was subtracted from the sum of the selling expenses with those of administration to determine the total of the expenses of operation.

Naturally, when there are no financial expenses and products, the sum of the selling expenses with those of administration forms the total of the operating expenses.