Concept in Definition ABC

Miscellanea / / July 04, 2021

By Florencia Ucha, in Oct. 2009

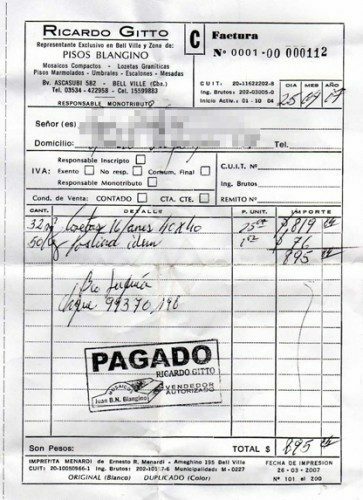

In the business world, the concepts of billing and invoicing are key to understanding business relationships and, at the same time, to keep track of accounting management. It is the main document of a purchase-sale operation and with it an operation is finalized and concluded.

In the business world, the concepts of billing and invoicing are key to understanding business relationships and, at the same time, to keep track of accounting management. It is the main document of a purchase-sale operation and with it an operation is finalized and concluded.

In the business management It is essential to keep detailed control over the invoices that are issued to customers. This whole process is precisely the billing, which also refers to the income business obtained from their sales, whether of products or services.

In any billing system there are three protagonists involved: the selling company, the client and the state body that controls taxation.

Written document that reflects the delivery and payment of a product or service

It includes that written document that reflects the delivery and payment of a product after its acquisition, or the provision of some type of service, in which no Only the date on which it was accrued will be indicated, but also issues such as the quantity, weight, measure and price of what was acquired.

In addition, the invoice will include the data corresponding to the sender and the recipient thereof, with the details of the products. and services that have been provided in a timely manner, their unit prices, total prices, discounts, taxes, signs and balances to cancel.

Essential to initiate claims

All these details are important because in the future, if it is necessary to make a claim because what was acquired or the service that was contracted do not comply with what was proposed or promised, the invoice turns out to be a very important and valid document to make the corresponding request for redress.

Now, we must indicate that many companies do not attend claims for failed purchases or for any defect in the product purchased if the client does not present the corresponding purchase invoice that proves that he has bought the product there and the date on which he has done so, the latter is very important because it allows the business to know when it was purchased and if both the product warranty and the expected time for changes.

Tax receipt for the delivery of a product or the provision of a specific service

In accounting matters, the invoice will be the tax receipt of the delivery of a product or the provision of a certain service that affects both the buyer and the seller and that will give the receiver the right from deduction value added tax (VAT). Invoices can be for three types A, B or C and these include the following: ordinary (documenting the commercial operation), rectifying (documenting corrections of one or more invoices previous or, failing that, returns of products, containers, packaging), recapitulative (they document groupings of invoices corresponding to a certain period).

The issuance of invoices is mandatory in commercial operations

The issuance of invoices is a mandatory matter in commercial operations, those who do not do so will be subject to suffer some type of fine, cancellation or even the closure of the business for not observing this obligation in the event that an inspection by the competent body in the matter detects it.

Tax evasion is certainly a recurring issue in the world and one of its main manifestations is precisely the failure to deliver the corresponding invoice to a customer or buyer. As the purchase is not recorded in any accounting document, the merchant will draw the payment of taxes corresponding to his commercial movements.

Reduce tax evasion

To reduce tax evasion, it is important that the state carry out campaigns that promote responsible fiscal behavior on both sides, the merchant and buyer, and of course also indicate the penalties that will be punishable if they do not comply with the regulations in force at the time respect.

The taxes that a merchant does not pay as appropriate will imply less money for the coffers of the state and this will directly affect those areas that benefit from that money, such as the safety, health and education public of a nation that is managed and sustained through taxes paid by taxpayers.

Manner in which an action is carried out

Because Invoice refers to the execution, to the way in which a certain action is carried out, for example, “Juan carried out a rough invoice job”. This would be the least frequent use of the word.

Sweet bun or cake sold in bakeries

Meanwhile, another of the uses of the term, especially in Argentina and Uruguay, says that invoice is a type of sweet bun or cake that is sold in bakeries and that are usually eaten for breakfast or as a snack to accompany tea, mate, coffee with milk or chocolate hot.

The most popular invoices are croissants or croissants, in its two forms, fat or butter, although there are also other compound variants and Filled with pastry cream, dulce de leche, quince paste, apple, covered with sugar, among other

They, as we said, are sold in bakeries, although they can also be bought in cafes or restaurants. They are sold by the unit, by the dozen or half a dozen of the same kind, for example, all croissants or combined.

Topics in Invoice