Concept in Definition ABC

Miscellanea / / July 04, 2021

By Javier Navarro, in Oct. 2016

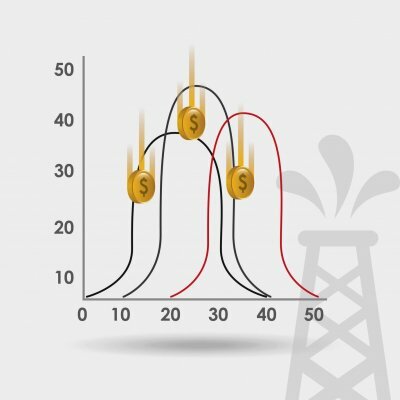

The acronym OPA corresponds to the concept of offer public shares. Thus, a takeover bid occurs when a company plans to place representative shares of its capital to the investing public.

The acronym OPA corresponds to the concept of offer public shares. Thus, a takeover bid occurs when a company plans to place representative shares of its capital to the investing public.

Types of public offering of shares

An OPA can be of several types: initial public offering, primary, secondary or mandatory. An initial public offering is one that a company makes in order to obtain external capital and this is carried out by placing shares to the public for the first time. There is talk of a primary public offering when a company places new shares to those that have already been previously issued and its immediate effect for the investors would be a dilution, that is, investors will have the same number of shares but will own a smaller percentage of the share. business.

A secondary public offering has as purpose transfer shares that were previously placed and in this type of offers an individual or group business offers a large number of its titles to the public and this will be the one who receives the capital flows from the sale of shares. Compulsory public offerings occur on those occasions in which a company must compulsorily launch a takeover bid for certain securities.

The different modalities of OPA have the objective of expanding the power of a company and, in parallel, diversifying its capital.

Hostile takeover

OPAS are part of the normal dynamics of finance. When an OPA occurs with the consent of the buyer and the seller, it is called a friendly OPA, but when there is no consent from the seller it is called OPA hostile. Colloquially, entities that hostilely attempt to acquire stocks are called financial sharks.

In any case, in the hostile takeover bid a paradoxical situation occurs: the shareholders of the company that receives the offer receive an amount of money that exceeds the value of its shares but said operation does not have the consent and approval of those responsible for the company and therefore this reason it is considered a hostile action. The hostility of the OPA is based on the lack of prior agreement between the buyer and the seller.

In any case, in the hostile takeover bid a paradoxical situation occurs: the shareholders of the company that receives the offer receive an amount of money that exceeds the value of its shares but said operation does not have the consent and approval of those responsible for the company and therefore this reason it is considered a hostile action. The hostility of the OPA is based on the lack of prior agreement between the buyer and the seller.

What rule Generally, a hostile takeover bid is launched when a company It has a double purpose: to improve its economic situation and, in parallel, to achieve a strategic position in the market. In some cases, the receiving entity (the opada company) and the entity that launches the OPA are part of the same business group and in this case the hostile OPA would be a strategy to increase the value of the shares in the market.

Photos: Fotolia - Gstudio

Topics in OPA