Concept in Definition ABC

Miscellanea / / July 04, 2021

By Florencia Ucha, in Nov. 2014

The concept that concerns us has a use excluding in the plane of finance and of the economy since it is the abbreviated way of calling a financial indicator very important and influential in terms of the benefits of a company.

The concept that concerns us has a use excluding in the plane of finance and of the economy since it is the abbreviated way of calling a financial indicator very important and influential in terms of the benefits of a company.

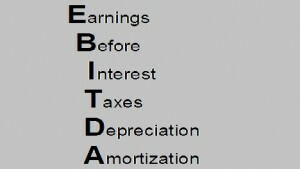

Basically EBITDA, is an acronym since it is made up of the initial words of the following words corresponding to the language English: Earnings before interest, taxes, depreciation and amortization, which put in terms corresponding to our Spanish language indicates: income before interest, taxes, depreciation or devaluation and amortization.

The gross benefits to be obtained from exploitation of something, of a business, for example, but taken before financial expenses are deducted from that gross, that is, the EBITDA will be calculated through the final operating numbers of a company and will not include all those figures that have to do with expenses for taxes, interest, depreciation or loss of value because the idea is precisely to know the

movement gross of the company, what it is capable of producing in total and without issues such as those already expressed and that reduce that final amount intervene in this final result. That is exactly what the indicator known as EBITDA shows.The importance of this indicator lies precisely in this question in demonstrating in a forceful and exact way what the company under study is gaining or is capable of gaining and also knowing how much it loses in that activity.

For example, for investors it is a very useful indicator to know since through it they will know if a business is profitable or not. For this matter, this indicator is also widely used at the request of the valuation of a company.

Of course, for any individual who is not especially dedicated to economic, financial issues, the term does not work for him. not at all familiar, however, those who are immersed in these contexts often use it and are very aware of this index.

Topics in EBITDA