Capitalizable Costs Example

Finance / / July 04, 2021

They can be called capitalizable costs, to those documents that are accounted for or classified as costs that can be capitalized as fixed assets or defined charges.

They are promises of payment that at a given moment can be translated as money or tangible capital, and therefore can be added as feasible costs of being usable capital.

They can be defined as capitalizable costs to:

- Bills of exchange (before their deadline)

- Checks

- Endorsements

- Promissory notes

- Banknotes

- Bearer shares

- Nominated shares

Example of capitalizable costs.

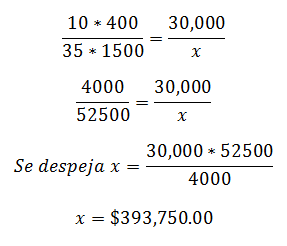

The company "gloves mejía S.A de C.V" needs to define its capitalizable costs, and for this it identifies how many documents collectibles has, and of these identifies 215 collectible documents that are in time and form to be used as documents capitalizable, or likely to be financed.

Given the circumstances, they are added to the accounts as capitalizable costs, as long as they do not prescribe.

Likewise, its accountants included as capitalizable costs, the bearer shares that are in the company's safe. As well as the bills of exchange that are endorsed in favor of the company.