Example of Balance Sheet With Report Form

Accounting / / July 04, 2021

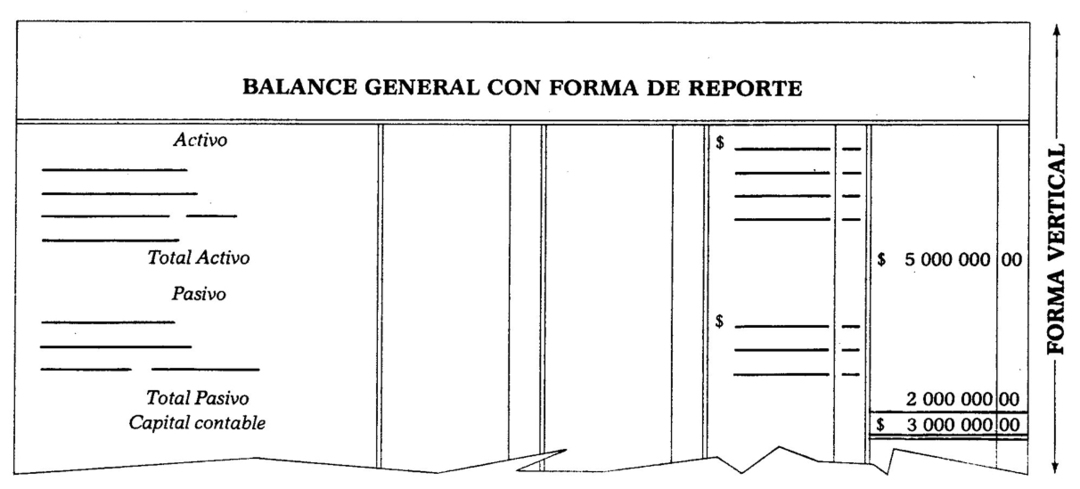

It consists of classifying Assets and Liabilities, on a single page, in such a way that at 76 The sum of the Assets can be vertically subtracted from the sum of the Liabilities, to determine the stockholders' equity. Example:

According to the above, we see that the Balance Sheet with report form is based on the formula:

Assets - Liabilities = Capital that expressed by means of literals remains:

A - P = C

78 This previous formula is known as the capital formula.,;

In order to illustrate the. Previous explanations a model of the Balance Sheet is presented on the next page in report form.

79 The Balance Sheet must be transferred to the Inventory and Balance Sheet book.

The Inventory and Balances book has a special line, distributed as follows: a large space intended for indicate the names of the accounts, and four equal columns with subdivision for pesos and cents, in which the quantities.

For the Balance to have a good presentation, the following indications must be taken into account:

80 1. The name of the business should be noted in the center of the sheet, on the first line.

81 2. The filing date should be noted leaving an indentation of more or less three centimeters,

on the second line.

82 3. The third line must be doubled, in order to separate the header from the body of the

Balance.

83 4. The names Assets, Liabilities and Stockholders' equity should be entered in the center of the space for

do to enter the name of the accounts.

84 5r The name of each of the groups that make up Assets and Liabilities must be noted at the

leaf margin.

85 6. The name of each of the accounts should be noted, leaving a small indentation, with the object

so that the names of the accounts are not confused with the names of the groups.

86 7. Only the dollar sign ($) should precede the first amount in each column, all of the

such and to the amounts that are written after a cut. *

87 8. The cuts should span the entire column.

9. Only the final result is cut with two horizontal lines.

10. No lines should be left blank, as the law prohibits it.

Annotation of the amounts. The notation of the amounts is very important; It must be done in such a way that to determine the Capital from the total Assets, the total of the Liabilities can be subtracted vertically. The most popular way is indicated below.

First column. In this case it is not used; later we will see when it is used.

88 Second column. The amount of each account must be entered in this column.

89 Third column. In this column the total of each group must be entered.

90 Fourth column. In this column, the totals of Assets, Liabilities and Capital must be entered.

91 Naturally, there are changes in the allocation of amounts; For example, when there is only one account in a group, instead of recording its amount in the second qolumna should be entered directly up to the third, since in fact it forms the total of the group.

It should be noted that the sums go to the next column, at the same height as the last addend.

* Cut is the horizontal line that is drawn when adding or subtracting.