The Comparative Balance With Report Form

Accounting / / July 04, 2021

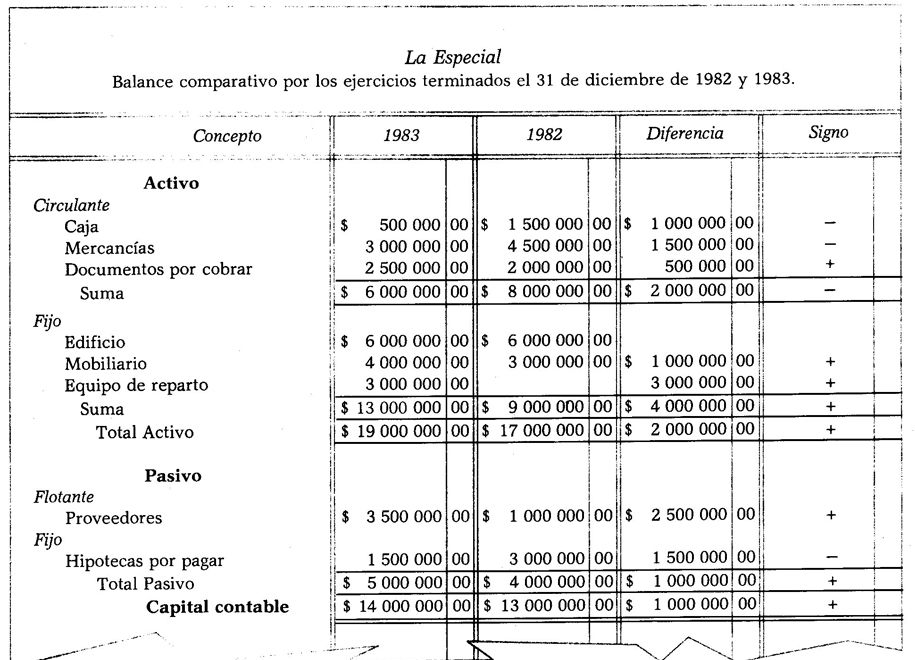

This way consists of classifying the Assets and Liabilities of the balances that are compared on a single page, in such a way that so that the sum of the Assets can be vertically subtracted by the sum of the Liabilities, to determine the Stockholders' Equity of both training.

In accordance with the above, the Comparative Balance with report form is based on the formula:

i Assets - Liabilities = Capital

To illustrate the above explanations, a model of Comparative Balance with report form is included on the next page. ni By means of the model it can be seen that in the Comparative Balance four columns are used to record the amounts of the accounts and their changes. /

Use of columns. In the four aforementioned columns, the amounts of both the initial and final Balance must be entered, as well as the amount of the alterations that each of the accounts have suffered. The following shows how these columns should be used.

First column. It is used to record the amount of each of the accounts involved in the Final Balance.

Second column. It is used to record the amount of each of the accounts that make up the Initial Balance.

The values of the Ending Balance, usually, are higher than those of the Initial Balance, so, placed in the indicated way, it is easier to determine the difference of each account, since by having the upper quantity first and the lower quantity second, it is easier to carry out the subtraction, than if they appeared inverted.

Third column. This column is used to record the alteration or difference of each account; This alteration or difference is obtained by comparing the amount of the Final Balance with the initial one; The difference obtained from comparing the sums of each group should also be noted in this column. and those obtained from comparing the Assets totals, Liabilities totals and Capital totals.

Fourth column. The fourth column is used to record the signs of + (plus) or - (minus); a plus sign is noted when the alteration or difference is positive, and a minus sign when it is negative. The alteration is positive when the amount of the Final Balance is greater than that of the Initial Balance; it is negative in the opposite case; examples:

How the positive and negative differences should be added in each of the groups

Positive quantities are added first, then by Quantities Quantities Comparison i

separately add the negative amounts, then positive negative amounts of the sums;

the two sums are compared, and the difference between the two is noted as a sum, in the difference column.

ii 7 The sum of the difference column is positive when the sum of the positive quantities is greater than the sum of the negative quantities; otherwise, the sum is negative.

If an account only has an amount entered in the final or initial Balance, this amount must appear as a positive or negative difference, as the case may be.

It is natural that in the event that an account has the same amount in both the Ending Balance and the Initial Balance, nothing is entered in the difference and sign columns.

When there are only positive or negative differences in a group, these can be added directly by be homogeneous quantities and the sum will be positive if the differences are positive or negative, in case contrary.

Checking the sum of the difference column. The sum of the column of differences is correct, if the difference between the sums of the first two columns is equal to it; In the above example, the sum of the first column is $ 95,000.00 and the sum of the second is $ 93,000.00, the difference Between the two it is $ 2,000.00, which is equal to the sum of the difference column, thereby checking that it is correct.

Once the sums of the groups have been verified, the total sums of Assets and Liabilities must be determined to obtain the Capitals.

The sums of Assets, Liabilities and Capital are also compared, their difference must be noted in the respective column, indicating whether it is positive or negative.

The difference between the Capitals, if positive, represents the profits obtained during the year; if it is negative, it represents the losses suffered during it. It should not be forgotten that

Capital increases can also be a consequence of new capital contributions being made, and decreases, motivated by the withdrawal of part of it.

Verification of the increase or decrease of Capital. The increase or decrease in Capital is verified based on the changes in Assets and Liabilities. To better understand the above, let us take as an example the changes in Assets, Liabilities and Capital that appear in the Comparative Balance Sheet model (form 3). In said Balance there is an increase in Assets of $ 2,000,000.00, a decrease in Liabilities of $ 500,000.00, and an increase in Capital of $ 2,500,000.00; As both increases in Assets and decreases in Liabilities increase Capital, adding these changes results in an increase in Capital of $ 2,500 000.00, which is precisely the one that appears in said Balance, with which it is verified that the Capital increase is correct, since it is also $ 2,500 000.00.

Interpretation of the comparative balance. To interpret a comparative balance sheet, it is not sufficient to examine whether Capital has increased or decreased, but rather it is necessary to make an analysis of the alterations that the resources and obligations of the owner have suffered, in order to obtain a clear concept of the progress, stagnation or regression of the business, since there are times when Capital has increased and, however, the financial situation, far from having improved, is less favorable than that of the year previous. To better appreciate what has been said, let us take the following comparative balance sheet as an example:

As can be seen, the Capital increased $ 1,000,000.00, because the Assets increased $ 2,000,000.00 and the Liabilities $ 1,000,000.00; However, this does not mean that the financial situation of the current year is better than that of the Previously, if we analyze the variations of the main Assets and Liabilities accounts, we find the following following:

The Cash Account decreased. Your current balance of $ 500,000.00 is not enough to pay off short-term debts of $ 3,500,000.00, while in the previous year the balance of said account did allow to easily pay the value of said debts.

The Merchandise account also decreased. Your current balance is $ 3,000,000.00, which is less than what is owed to providers; whereas in the previous year, the stock reached $ 4,500,000.00, of which only $ 1,000,000.00 was owed.

The decrease in Cash and Merchandise accounts was caused by the increase in Fixed Assets, which originated from the purchase of furniture and equipment of distribution, which indicates that the Current Assets, which is the one that represents the immediate means of action of the business, has not been duly administered. Regarding Liabilities, we find that «1 Fixed liability, which represents long-term debts, decreased, while Current liabilities, which condemn short-term debts, increased, which reveals that the way to settle the obligations has been bad.

After analyzing the previous points, we find that, despite having increased the Capital, the current financial situation is less favorable than the previous year, due to the mismanagement of the means of action and the way of paying the obligations.