Variations In Accounts

Accounting / / July 04, 2021

Until now, it has been indicated that to know the values with which the financial statements are formed, it is necessary to keep a series of accounts to record in them all the variations that affect the elements of Assets, Liabilities and Capital, due to the operations carried out by the business.

In this chapter we are going to see everything related to how to register operations in these accounts.

To correctly record the variations in the values they represent in the accounts, it is necessary to consider both the cause and the effect produced by each operation, since no matter how simple it may be, it will affect at least two accounts.

In order to analyze the above, let's look at the following examples:

1. If we buy merchandise and pay for it in cash, we must consider, at the same time and for the same amount, both the increase in Assets in merchandise and the decrease in Assets in cash.

2. If we pay in cash a bill of exchange at our expense, we must consider, at the same time and for the the same amount, both the decrease in Liabilities in documents payable, and the decrease in Assets in box.

3. If we pay cash for an expense, we must consider, at the same time and for the same amount, both the decrease in the expense suffered by Capital, and the decrease in Cash Assets.

4. If a client pays us his account in cash, we must consider, at the same time and for the same amount, both the increase in Cash Assets and the decrease in Customer Assets.

5. If we buy merchandise for $ 50,000.00, of which we pay $ 30,000.00 in cash and the rest on credit, we must consider, at the same time, the increase in the Assets in merchandise for $ 50,000.00; the decrease in Cash Assets by $ 30,000.00 and an increase in Liabilities in suppliers by $ 20,000.00.

As can be seen in the previous examples, whatever the operation was carried out, there will always be a cause and an effect that, by the same amount, will vary our values of the Balance.

The variations, that is, the increases and decreases suffered by the values of Assets, Liabilities and Capital, by the operations carried out in the business must be recorded in the corresponding accounts by means of charges and fertilizers.

Now, as the accounts represent values of a different nature, the problem arises of knowing what charges and which credits will mean the increases or decreases in the different accounts of Assets, Liabilities and Capital. To solve the problem of knowing which charges and which credits are going to mean the increases or decreases in the different accounts, the Balance formula is taken as a basis, which says:

A = P + C

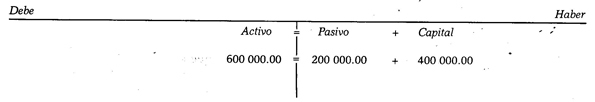

To explain why the Balance formula is taken as a basis, we are going to place it in the following account scheme:

As we see in the previous diagram, Assets appear charged, while Liabilities and Capital appear paid.

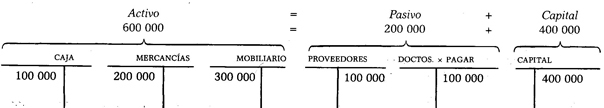

If we assign an account for each of the three elements of the Balance, according to the same formula, they look like this:

Therefore, yes to each of the values that make up Assets, Liabilities and Capital, we assign an account, according to the same formula, they look like this:

Based on the above, it was determined that:

1. Every Asset account must start with a charge, that is, with a debit entry.

2. All Liabilities account must begin with a credit, that is, with an entry to credit.

3. The Capital account must start with a credit, that is, with a credit entry.

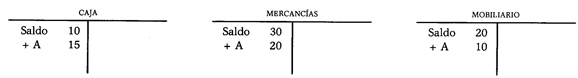

As Active accounts start with a charge, it is natural that to increase their balance they must be charged. Example:

Instead, to reduce your balance they must be paid. Example:

Observation:

a) Asset increases are charged.

b) Asset decreases are paid.

The balance of the Asset accounts will always be a debtor, because its creditor movement can never be greater than the debtor, since it is not possible to have more values than there are; for example, the cash register will never be able to leave a greater amount of money than what is in stock.

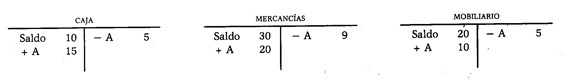

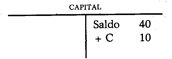

As Passive accounts begin with a credit, to increase their balance they must be credited. Example:

On the contrary, to decrease your balance they must be charged. Example:

Observations:

a) Increases in Liabilities are paid.

b) Decreases in Liabilities are charged.

The balance of the Liability accounts will always be creditor, because the debtor movement can never 213 be greater than the creditor, since it is not possible to pay more than what is owed.

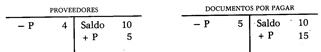

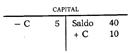

If we bear in mind that the Capital account begins with a credit, it is natural that to increase its balance, it must be paid. Example:

Instead, to decrease your balance it must be charged. Example:

Observations:

a) Capital increases are paid.

b) Capital decreases are charged.

The balance of the Capital account is usually creditor, because almost always increases in capital are greater than its decreases, only in the opposite case will it have a balance debtor.