VAT Accounting Record: Background

Accounting / / July 04, 2021

The knowledge that concerns the accounting record of the value added tax is of utmost importance not only for people studying accounting principles, but also for those studying intermediate or advanced.

The value added tax intervenes in a number of operations, its accounting record must be done taking into account several legal aspects, such as: the rate, the activity of the company, the location area, the special concessions granted, etc., aspects that vary according to the law and regulations of each country.

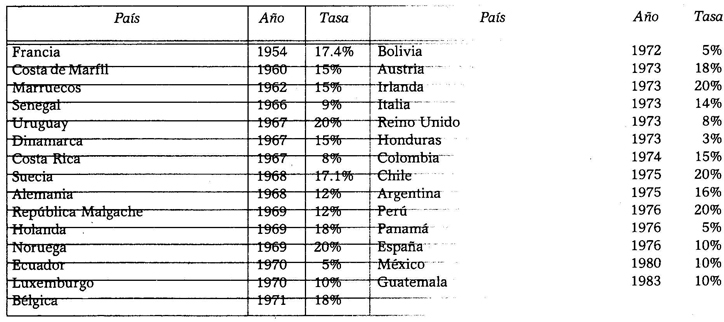

Below are some of the countries that have adopted the value added tax, as well as the year in which it was implemented and its corresponding general rate.

Value added tax rates frequently undergo modifications as changes arise in the social and economic development of each country; For this reason, for its correct application, it is necessary to know the legal provisions that contain the current rates. In Mexico, the Value Added Tax Law was published in the Official Gazette of the Federation, on December 29, 1979 and entered into force throughout the Republic on the 1st. January 1980.

On December 31, 1982, the rates of this tax underwent modifications, remaining as follows: 361: 0%, 6%, 15% and 20%, and they came into effect as of day 1. of January 1983, to be applied in accordance with both the values indicated in this law, as well as the place or area where the acts or activities are carried out.

The value added tax repeals or replaces, among others, the federal tax on business income 362, whose main deficiency It was based on the fact that it was caused in a "cascade", that is, that it had to be paid at each stage of production and marketing, determined in all of them, an increase in costs and prices, an increase whose cumulative effects, in short, affected the final consumers.

The value added tax eliminated the harmful results of the federal income tax- 363 cantiles, as it destroys the cumulative cascading effect and the influence it exerts on the general levels of prices.

The value added tax, although it is also paid in each of the stages of production 364 and marketing, does not produce cumulative effects, since each industrial or merchant, upon receiving the payment of the tax that he transfers to his clients, recovers the one that his suppliers would have passed on, and only delivers to the State the difference; In this way, the system does not allow the tax paid at each stage to influence the cost of the goods and services, and when they reach the final consumer, no burden is hidden in the price fiscal.