Companies That Perform Activities Only Subject To The 0 Percent Rate

Accounting / / July 04, 2021

In companies whose activities are subject to the 0% rate, both the tax that their suppliers pass on and the one that they pay for expenses and provision of services, must be registered separately from the consideration, that is, it should not be increased to their costs and expenses, because in this case, taxpayers have the right to request the return of said tax to the Ministry of Finance and Public Credit, inasmuch as they do not transfer any tax to their clients, because the rate to which they are subject is 0%.

This class of companies does require a number of. State account or registry with the offices, collectors of the value added tax, which is delivered to them when they notify the authorities corresponding (Treasury of the Federation), precisely said number or registration is an essential requirement to request the return of the accreditation of the tax.

To better understand this, the resolution of operations carried out by a company in which its activities are subject to the 0% rate is presented below.

Operations.

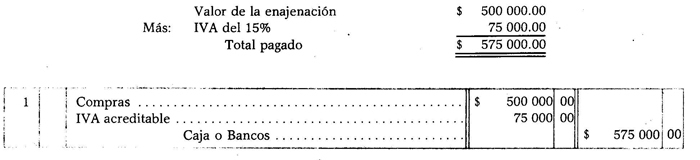

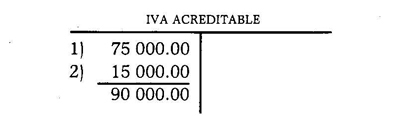

1. Goods were bought in strict cash, according to invoice 512:

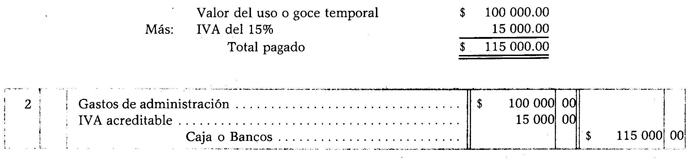

2. The rent for the offices corresponding to the current month was paid, according to receipt 605:

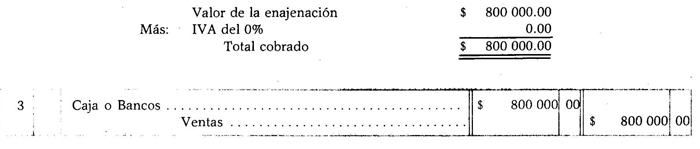

3. Goods were sold for $ 800,000.00, which are subject to the rate of 0% of value added tax, according to invoice 1321:

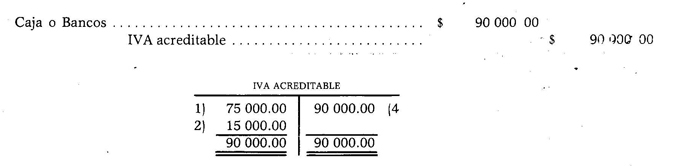

4. In this case, the refund of the tax credit will be requested for $ 90,000.00. When the Secretary of Finance and Public Credit returns said tax, the following entry will be run: